In my previous article we discussed the Trust Equation and how individuals and organisations with High Trust relationships could achieve a Trust Dividend whereas Low Trust environments were more like having a Trust Tax. So as a finance professional how can you start to build out these High Trust encounters?

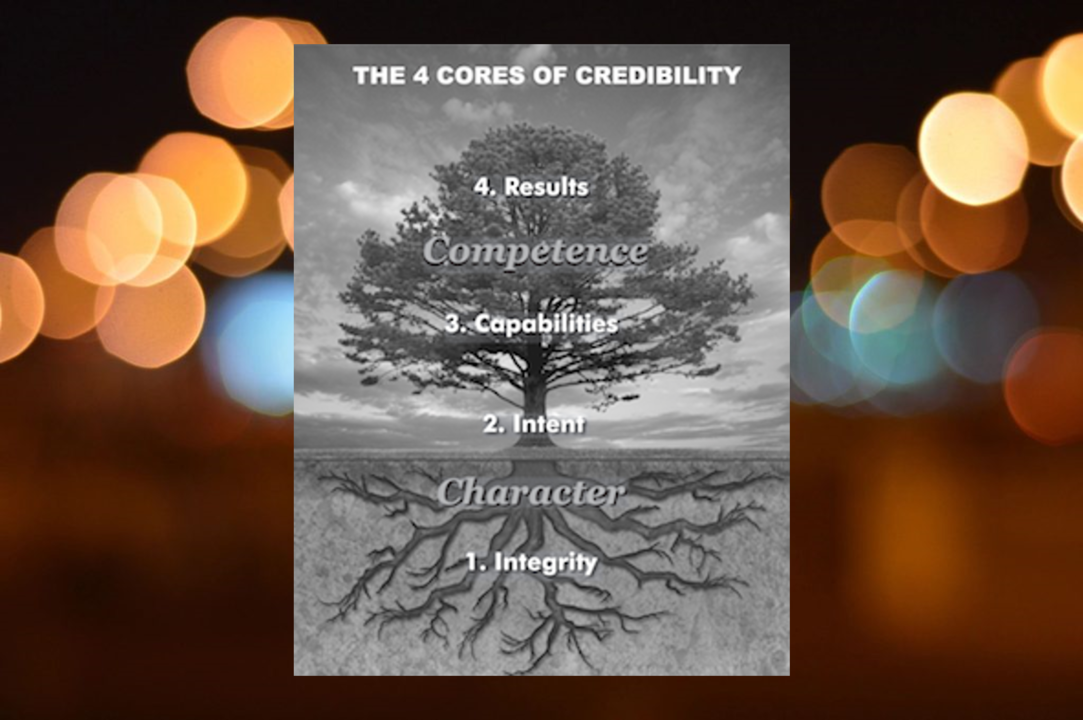

The great thing about being in Finance is that we get to observe in real life and hear stories about many interactions, good and bad, between many colleagues across the business. I’ve even tried many different approaches to building trust myself but the best way I’ve seen of describing the process and practically implementing it in a way that works is actually based around some ideas from “The Speed Of Trust” written by Stephen M. R. Covey where he represents building trust like a well rooted tree born of two dimensions: character and competence (see image of a tree above).

Character includes your integrity, motive, and intent with people. Competence includes your capabilities, skills, results, and track record.

Both dimensions are vital. For instance if the competence, which is represented by the branches, leaves and fruit of a tree above the ground is strong, because we’ve a known track record of producing accurate and complete reports as well as supporting some successful decision making, but our character is weak because we don’t keep our commitments or others perceive we have a hidden agenda then when a storm comes along the tree will be blown over. We will not have built sustained trust.

Similarly, let’s imagine a colleague who is sincere, even honest, would you trust that person fully if he or she doesn’t get results or have the skills to deliver the required outcomes?

How to build trust

Step 1: Is a bit like the airline metaphor when the oxygen mask drops in the event of a loss in cabin pressure and you have to tend to yourself first before helping other passengers. You’ve got to start with yourself.

Step 2: Is to find opportunities to build your own credibility by balancing each of the 4 Cores of Credibility: Integrity, Intent, Capabilities, and Results. As we all know in finance a person’s reputation and brand is a direct reflection of their credibility, and this precedes them in any interactions or negotiations they might have. When our credibility and reputation are high, it enables us to establish trust fast. Recall the trust equation from the last article speed goes up, cost goes down and results get better.

Luckily there are 13 behaviours that have been identified in high-trust leaders around the world that act like force multipliers in building and maintaining trust. When you adopt some or all of these ways of behaving, it’s like making deposits into a “trust account” of another party like I wrote in my book:

1. Talk Straight

2. Demonstrate Respect

3. Create Transparency

4. Right Wrongs

5. Show Loyalty

6. Deliver Results

7. Get Better

8. Confront Reality

9. Clarify Expectation

10. Practice Accountability

11. Listen First

12. Keep Commitments

13. Extend Trust

Step 3: Is that you’ve got to begin to allow yourself to trust others, because if you don’t trust other people how can you expect them to trust you? In effect you’ve in got to give to get.

And these are all characteristics demonstrated by the guest mentors on our Strength in the Numbers show. The reason why they’ve become so influential as finance professionals and gone on to solve meaningful problems for their organisations is that they practice these behaviours day-in, day-out, and it’s because they have built up their credibility and the trust others have in them by having great character, built on integrity and no hidden agendas, that’s why their willing to freely share with you their hard won lessons on the show in a way you can practically implement in your work, as well as continually working on improving their capabilities and delivering a track record of results.

So what techniques would you recommend to build trust with others and increase your impact in the business? Or what steps would you take yourself?

The author Andrew Codd is the producer of the Strength in the Numbers Podcast which interviews real finance practitioners to break down their hard won lessons and deconstruct their practical methods that work on the job and which you won’t typically find in textbooks or exams so that we create more influential accounting and finance professionals worldwide who solve meaningful problems for their organisations and in return have fun, rewarding and successful careers in finance.